As you begin planning your company’s ESG goals for 2018, consider the below questions to help drive your priorities.

- Did your company meet its 2017 ESG goals?

- What measurement system(s) are you using to determine if the goals were met?

- Did you use a Data Framework, ESG Standard, Rating, Ranking or Index as part of your ESG process?

Environmental, Social and Governance (ESG) is defined by Financial Times as ‘a generic term used in capital markets and by investors to evaluate corporate behavior to determine the future financial performance of companies’.

In layman’s terms, ESG performance data is information used to manage material risk and performance associated with an investment, company or asset. The socially conscious investor will utilize ESG data in combination with financial health in determining the course of their future investment.

More and more investors are using ESG data when deciding where to deploy their capital. This data is sourced from service providers such as the Dow Jones Sustainability Index (DJSI) – which holds the longest running global benchmark, reported to platforms such as GRESB or CDP – depending on the sector and focus, or published following guidelines such as GRI, SASB or PRI.

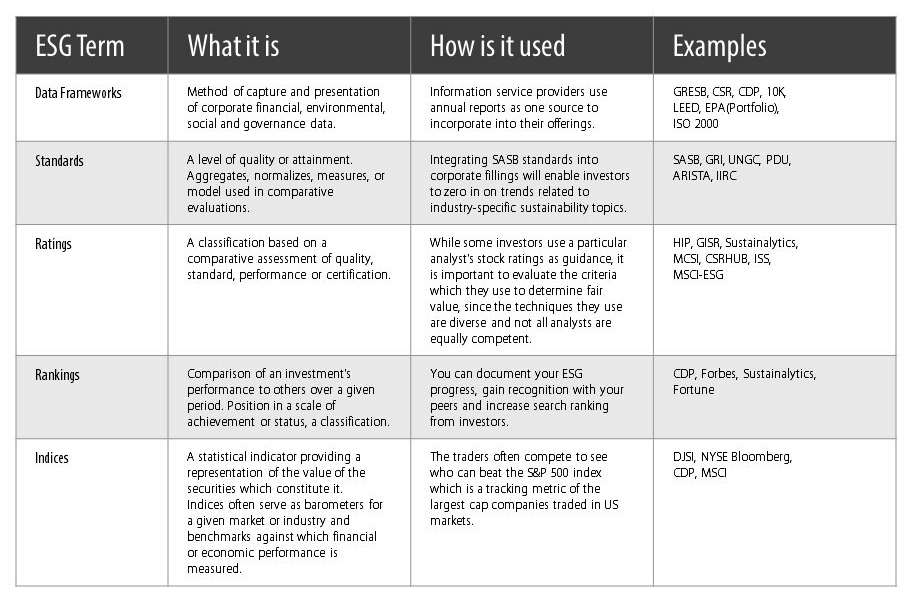

Below is an explanation of standard ESG terms including common usage and examples.

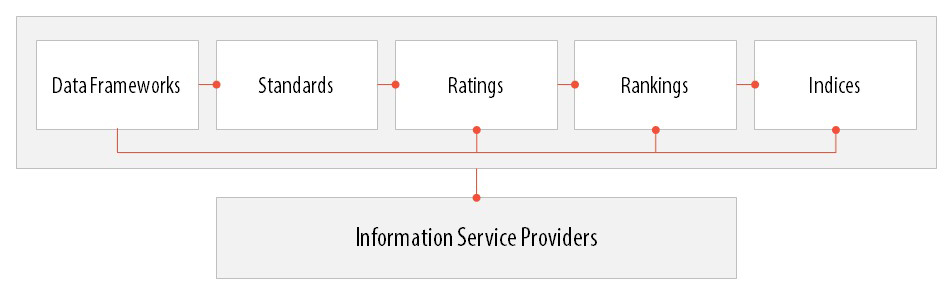

The following drawing depicts how each term relates to one another.

Whether you are new to ESG, an expert ESG practitioner, or looking to set your 2018 ESG goals, a good place to start is by answering the 3 questions at the top of this article.

This article is written by Julius Caten at Real Foundations.