Bloomberg recently reported that in 2017, across all industries, twice as many funds with an Environmental, Social and Governance (ESG) investment strategy were created compared to 2014. The flow of capital to environmentally and socially conscious companies is ramping up. On top of that we are also seeing investors divest support for companies that are not disclosing climate change risk. Aviva Investors have recently called for the recommendations of the FSB’s Task Force on Climate-related Disclosures (TCFD) to be made law by the end of 2018, signalling the desire from investors to see greater transparency and leadership from the companies they invest in.

We believe there has never been a better time to demonstrate leadership in ESG management and reporting in order to attract funding from this growing sector of the investment community.

What is the process for developing leadership?

The GRESB benchmark report is an excellent place to start annual reflection of performance relative to peers and industry best practice for those in the real estate sector.

Demonstrating leadership is about two things; having your standard ESG management practices in place and performing well, in addition to pushing the industry forward in a chosen area(s). The GRESB Benchmark allows you to focus on the core aspects of your strategy that you need to get right and the report is a great starting point.

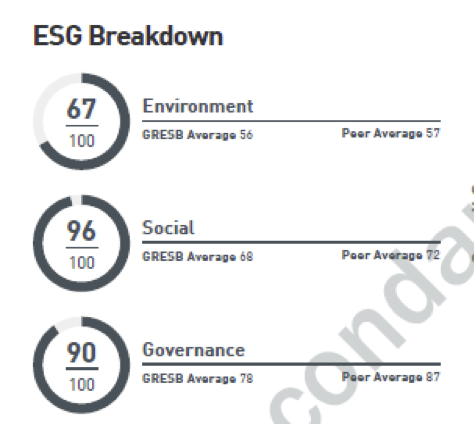

Starting with the ESG breakdown, you can quickly assess which part of your ESG strategy needs most focus.

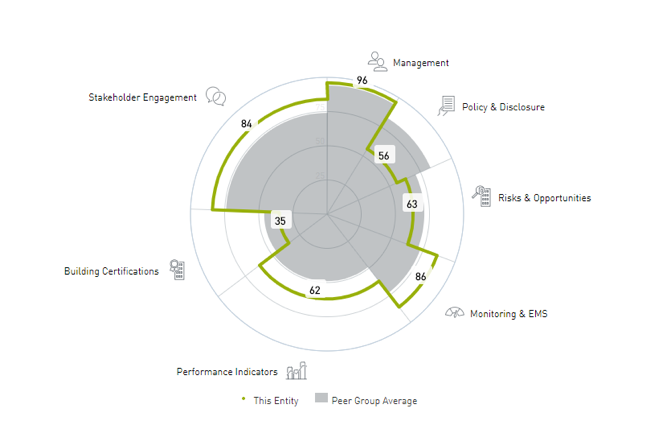

Another key output of the scorecard is the Aspect assessment. We use this visualization with our clients, to start to hone in on the areas where they can make most impact and identify where they aren’t demonstrating a high level of leadership at present against their peer group.

There are many frameworks and approaches to achieving leadership but we find that the GRESB benchmark report provides the greatest clarity for our clients when deciding where to spend time, effort and money. No company has unlimited resources to throw at ESG management, so it is important to focus your efforts on areas you can excel but also ensure you are maintaining ESG ‘hygiene’. A key point to recognise here is, you need both to be considered a true leader.

GRESB supports two further aspects of achieving ESG leadership.

The comparison to peers is a vital component in sense checking your performance outside of your own company. As we already described, leadership is about pushing the industry forward and this can only be achieved if you are performing at a level above your peers in one or more aspects of ESG management.

GRESB helps identify areas where you may be a laggard but also areas that you are excelling in that you can seek to further develop and drive.

Finally, the additional GRESB modules, notably Health & Wellbeing and Resilience, help you keep on top of changing trends within the industry.

ESG is a fast paced industry and leadership can sometimes falter in the face of multiple interests and competing ‘next big trends’. GRESB responds to changes in the market in a considered fashion, allowing you to take a measured approach and maintain focus on the key areas for your strategy.

Carbon Credentials works with many clients responding to GRESB and undertakes a benchmark review to help our clients understand where they can focus to demonstrate leadership in ESG. Find out how we can help you.

This article is written by Joe Pigott, Associate Director, Carbon Credentials.