GRESB Green Bond Working Group, January 2016

GRESB Green Bond Working Group, January 2016

The third meeting of the GRESB Green Bond Working Group (GBWG) addressed the costs and benefits of green bond issuance and investment. GRESB presented original research on the performance of corporate real estate green bonds, sharing its findings on the quantitative costs and benefits identified, to date. Speakers, including two green bond issuers from the property sector, Digital Realty and Stockland, and an asset manager, BlackRock, presented complementary qualitative factors grounded in their own experience. A lively discussion and Q&A, open to all participants, followed.

Insights from market research

The financial benefits of green bonds have been a recurring topic within various publications. A recent study from Barclays (The Cost of Being Green, September, 2015) concluded that investors may be paying a premium of 20 basis points to acquire green bonds in the secondary market. Few other studies exist, but those that do present less definitive results.

In order to provide working group members with an overview of market trends specific to the real estate sector, GRESB conducted in-house research and data analysis on the sample of green bonds issued by real estate corporates, to date. (The same sample represents the CRE universe, as defined in the second working group meeting on green property bond metrics.) In this case, we studied not only the overall performance trends of green property bonds, but also the pairwise performance of green vs. grey (non-green) bonds, from the same issuer. Pairs were selected using matching principles in order to ensure comparability. The research presented below outlines several interesting trends.

Trends and Highlights:

- The structure of green bonds—the rate type, amount of issue and market focus—is aligned with the overall debt structure of the issuer;

- Among comparable pairs from the same issuer, coupons for green bonds are higher than those for grey (non-green) bonds. This trend persists even when matching principles are relaxed.

- Green bond price volatilities are similar or slightly higher than the volatilities for their grey counterparts, but this pattern is highly issuer dependent;

- For six of the seven real estate corporate issuers studied, green bond yields were above the issuer’s yield curve (or trend line for grey bond issues). This would imply an investor discount for green, not a premium. However, pairwise yield comparisons revealed that higher green bond yields are not always the case. Thus the results on yields are inconclusive.

Of note is the limited data currently available. The trends mentioned above require more robust analysis and more data points before conclusions can be drawn. While some real estate corporates have realized a pricing break with green bond issues, this is not always the case, and pairwise analysis identifies possible inconsistencies. The higher volatilities of green property bonds may reflect strong investor demand, shortage of supply, and the buy and hold strategy of institutional investors. It is too early to draw distinct patterns within the CRE universe of green bonds, but the trends outlined above are nonetheless noteworthy and deserving of follow-on study.

Insights from the GBWG dialogue

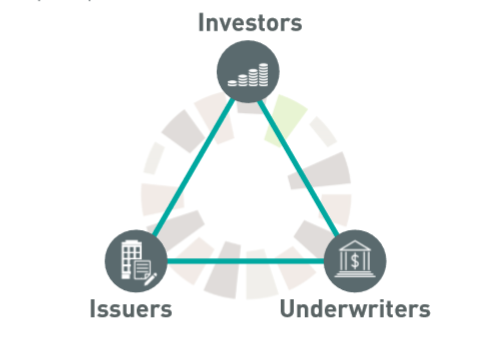

The global GRESB Green Bond Working Group continues to grow in tandem with interest in the green bond market. Currently 18 active working group members lead engagement and discussion. 35 GRESB Members joined the third session. Various group members, plus one guest speaker, shared their views on the costs and benefits of green bonds, as summarized below:

- Issuers confirmed that green bonds are considered within the context of their overall funding strategy. Some issuers made minor adjustments to their green bond offering, as a result of discussion with potential investors prior to issuance (including roadshow feedback). This underlines the necessity of such communication, which facilitates strategic messaging and investor understanding of the green bond. Most issuers adjusted their initial issue amount upward. All issuers realized investor diversification.

- Most issuers found that there was a significant learning curve associated with their first green bond issue. The upfront work — research and internal conversations about use of proceeds, accounting and auditing — was required to initiate their green bond offering from a place of full understanding and buy-in throughout the organization. However, for these issuers, already engaged in the sustainability issues relevant to the performance of their real estate portfolios, this upfront cost was more one of time and resources than additional monetary expense. Leveraging existing standards, such as the Green Bond Principles, was also cited as beneficial in establishing a green bond framework. Similarly, investors expressed their reliance on independent, third party verification of a bond’s use of proceeds and impacts, while allocating existing resources to develop a more holistic analysis of the particular bond.

- Issuers agreed that some flexibility within the framework for eligible green project selection is imperative in order to avoid the potential high costs associated with small scale energy improvements and monitoring. Selecting a range of green building certification levels or allowing for third party engineering reports to assure some projects, may be a way for issuers to balance the need for eligible green project pipeline with the cost of high impact verification.

- Strong investor demand for allocation to green bonds is apparent and fueled by appetite for social benefit. This trend is contributing to more and more capital targeting a relatively small number of corporate bond issues. Such supply/demand disequilibrium could lead to a (green/grey) pricing differential. However, the consensus among issuers and investors is that there is no clear indication of a secondary market pricing difference, and that limited data plays a role in this inconclusiveness.

- The cost of impact reporting was difficult for some issuers to estimate. Annual reporting is typical, and some issuers had not yet been through the first annual cycle since issuance. Others report green bond impacts or outcomes in conjunction with their annual report or less frequent sustainability reporting, making isolation of green bond reporting costs, challenging.

When asked what developments they would like to see in the green bond market over the next twelve months, working group members stated the obvious: market growth. Clearly, more transactions would mean more investable supply and more precedents for issuers to piggyback on. Market growth would also supply more data for studies on performance and lead to a greater understanding of how green bonds behave in relation to their non-green counterparts. Greater transparency was also mentioned, but interestingly, not in relation to issuers or use of proceeds; rather, transparency related to investor actions. The big question for 2016: what are the ins and outs of why investors are targeting green bonds?

This article is by Sara Anzinger.