See the 2024 Real Estate Results and the 2024 Infrastructure Results.

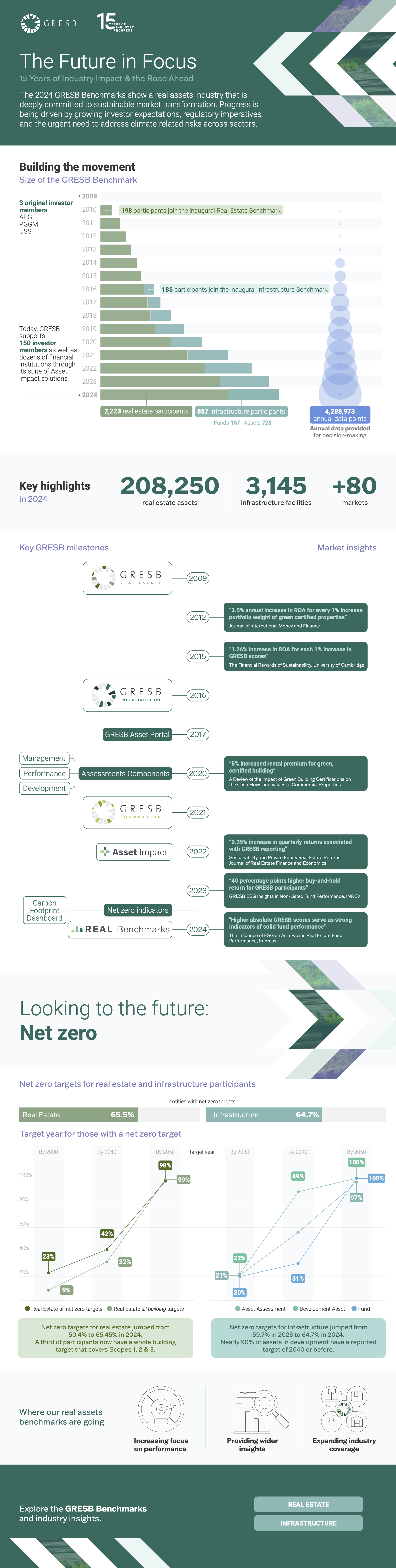

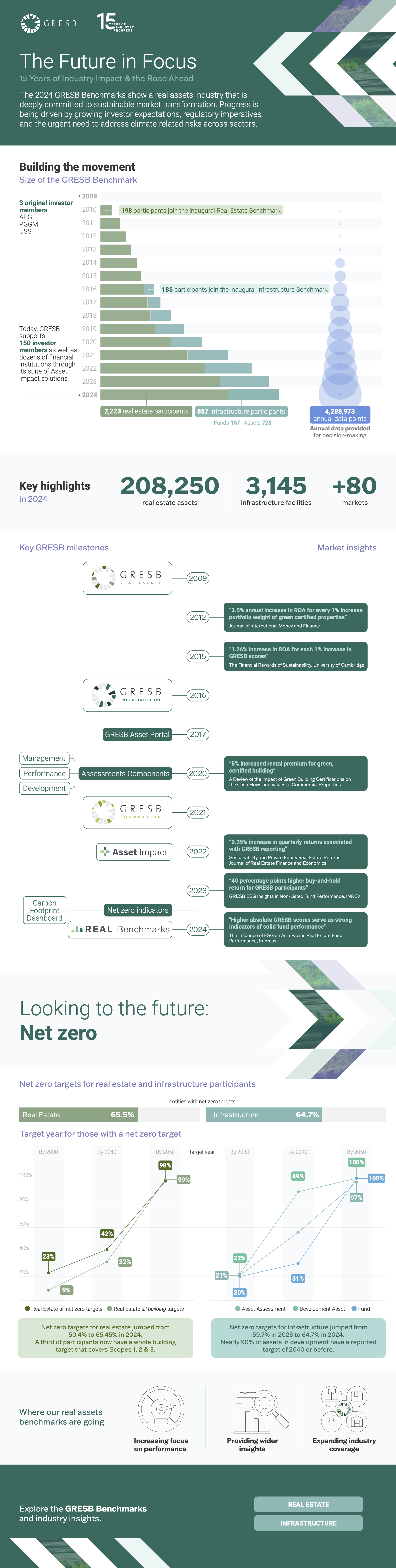

The 2024 GRESB Public Results are now available. You can find a summary of our Global and Regional Events.

See the 2024 Real Estate Results and the 2024 Infrastructure Results.