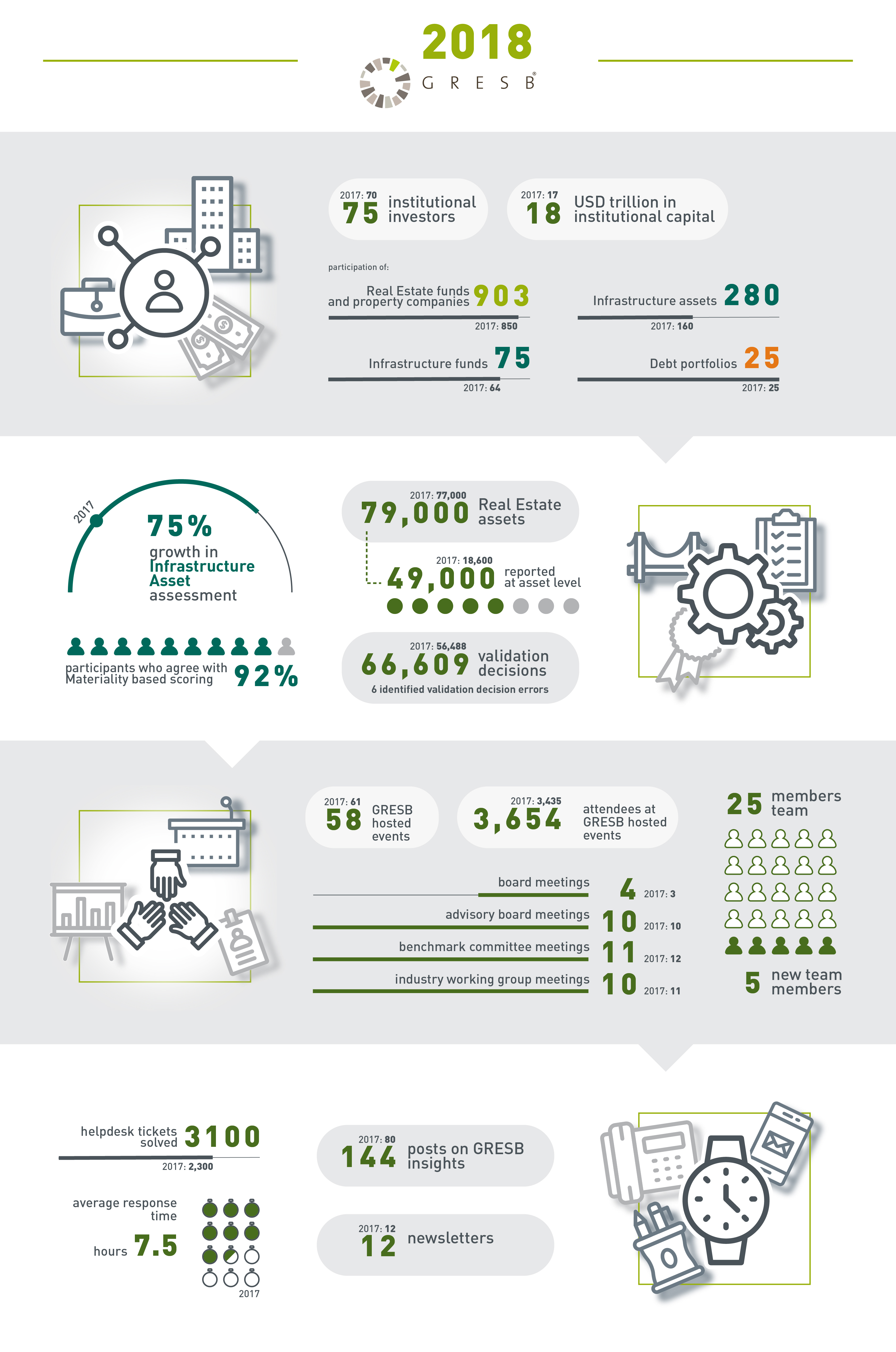

2018 was another inspirational year for GRESB. A growing number of institutional investor members, now controlling assets valued at USD 18 trillion, called on real estate and infrastructure managers to report on their ESG performance. The industry responded decisively, with 903 real estate companies and funds, 75 infrastructure funds and 280 assets stepping forward to participate in the benchmark. 79,000 real estate assets valued at USD 3.5 trillion are now represented, with infrastructure coverage growing to USD 0.6 trillion.

The infographic below collects together the highlights of the year in numbers:

This process of annual ESG performance benchmarking on such a large scale has built a powerful global ecosystem of investors, managers and industry bodies empowering everyone to work towards a shared vision of sustainable real assets. It’s been a pleasure to see best practices diffuse across the world and witness first-hand the power of capital markets to shift the real asset industry towards a more sustainable path.

But even with ESG action accelerating around the world, there is much more work ahead of us. In many ways, the stakes have never been higher for the industry and GRESB to drive forward the sustainability agenda. As we approach 10 years since we launched the inaugural GRESB Real Estate Assessment, it’s time to take stock of our progress and look ahead to the next phase of our work.

As an industry-led benchmark, this process begins by soliciting feedback from our governance bodies, listening to member commentary from GRESB working groups, and engaging with the broader industry that relies on our Assessments and benchmarks. Over the years, as GRESB coverage has grown and new use cases have emerged, a consistent theme has come up in our discussions: The need to offer greater reporting flexibility and more customized outputs. The clear message is to add this flexibility while still providing a single, standardized benchmark that can be applied across portfolios of real asset investments globally.

Introducing the next generation of ESG benchmarking and disclosure

Building on everything we have learned from almost a decade of benchmarking ESG performance, we’re designing a new approach to our Assessments that will provide access to consolidated ESG performance at the portfolio level, underscored by improved data quality at the asset level.

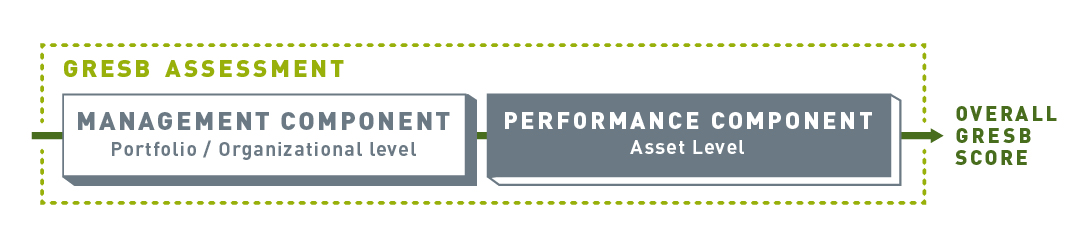

The transition will take place progressively from 2020, when both the GRESB Real Estate and Infrastructure Assessments will be divided into two complementary parts: A Management Component and a Performance Component. The two components reflect the existing dimensions of the GRESB model, as well as natural differences in what ESG data is collected by participants, how it is collected, and the type of entity that collects it:

- The Management Component will focus on entity management, policies and processes, comprising relatively static information collected at the organizational or portfolio level.

- The Performance Component will cover annual performance data derived from the asset level.

The GRESB Score – calculated as a combination of the Management and Performance Components – will remain in place as the ultimate expression of ESG performance. While additional layers of flexibility will be available to both participants and investors, the overall GRESB Score will continue to underpin the GRESB ratings and drive the global benchmark, just as it does today.

Improving usability, experience, data quality and analytics

The Management Component will open up the Assessments to new participants not yet reporting to GRESB. For example, it will provide a logical first step for participants getting started with their ESG integration (including those in emerging markets), enabling them to become familiar with the GRESB reporting process, identify priority issues and map out their sustainability program. New mandates that are raising capital, undergoing due diligence, or constructing a portfolio will also find value in the Management Component as a way to share structured ESG information with investors during the fundraising process (thereby replacing the current Real Estate Pre-Assessment).

The Performance Component will enable us to introduce a new suite of data-driven benchmarking tools and flexible outputs for participants seeking more granular asset-level insights. For example, the ability to create customized peer groups, compare sub-portfolios, and explore the contribution of an individual asset to portfolio environmental or social outcomes and impacts. This means creating simple, at-a-glance views in the GRESB Portal of specific metrics that a participant is interested in, together with new aggregated data insights for investors.

This new Assessment structure will extend the reporting timeline, reducing pressure on participants to report only during a three-month window. The goal is to significantly reduce the reporting burden via streamlined asset-level performance data updates in the Performance Component (e.g., by using GRESB API connections) while requiring regular updates to the more static organizational information reported via the Management Component.

For our institutional investor members, splitting the Assessments into the two component parts will allow us to create more tailored and context-appropriate analytics. Some GRESB investor members are now seeking tailored portfolio reports using custom indicators, or KPIs aligned with initiatives such as the UN Sustainable Development Goals and the TCFD recommendations as well as other broad-based reporting frameworks such as GRI, PRI and SASB. Others are looking for enhanced portfolio foot-printing based on accurate, aggregated portfolio level data and alignment with investor-led initiatives to tackle climate change. We’re also receiving interest in using flexible aspect weightings in the Portfolio Analysis tool, along with the ability to define materiality for different investment strategies and portfolio construction approaches.

Benchmarking real-world performance and impact

The way ESG factors are being adopted into mainstream investment decisions continues to evolve. We’re already starting to see new models of investor behavior from our member base that integrate measures of impact alongside risk and return. The division of our Assessments into the two component parts will enable us to better support this market trend.

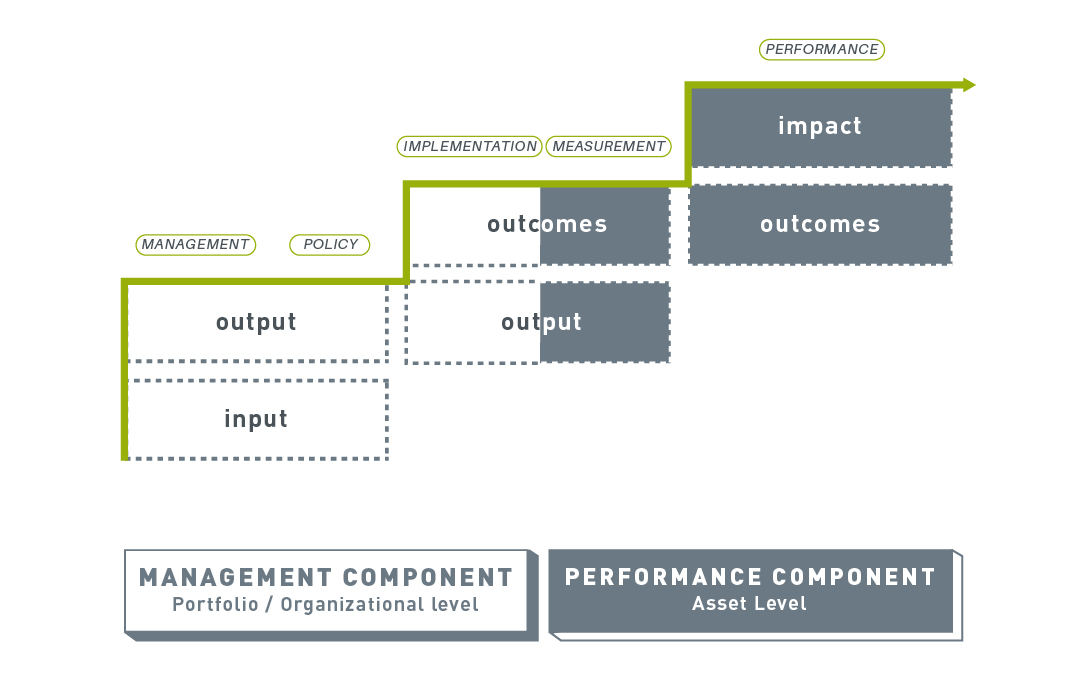

Specifically, management inputs and outputs (e.g. policies put in place and measures taken at the organizational level with the intent to improve ESG performance) will be addressed by the Management Component. The outcomes and impacts realized by these actions will be captured in the Performance Component. The diagram below illustrates this progression.

While measuring impact is not an easy task, an industry consensus is slowly coming into view on how best to do this. We’re seeing this among our Investor Members where there is an emerging convergence toward aligning with the UN Sustainable Development Goals and the TCFD recommendations. This is an evolving area and we are focused on working closely with our members and the broader industry to ensure our indicators are firmly aligned with the most important frameworks and designed to help participants understand their impacts and progress toward targets.

We will underscore this keener focus on performance in two ways: First, by progressively placing a higher weighting of the Performance Component towards the overall GRESB Score and second, by introducing a requirement for asset-level reporting. This dual approach will provide multiple industry benefits including new granular analytics for participants, increased investor confidence in the quality of reported ESG data, and better benchmarks of sector progress at the aggregate level.

In addition, with ESG risks becoming more acute and material to long-term performance, expectations around quality and validation are growing. That’s why we have started the process of developing a new GRESB ESG Data Quality Standard to define the rules for high-quality data reporting. The Standard will draw on best practices and principles in data quality used by experts across different industries, applying them to ESG data to complement our existing validation processes. Read more on the GRESB ESG Data Quality Standard.

Focus areas for 2019

In 2019, we will engage with a broad cross-section of industry leaders, advance critical global conversations with our investors, participants and partners, and establish the building blocks for the GRESB Assessments from 2020 onwards. A crucial success factor will be the constructive collaboration between all our stakeholders as we work together to raise the bar for global ESG performance benchmarking.

Our focus areas align with the three strategic pillars that guide our planning process: Stakeholders, Technology and Assessments.

1. Stakeholders: Investors, Participants and Partners

Ever since GRESB came into predominance as an initiative of a group of institutional investors, we have developed our strategy in direct dialogue with the industry. GRESB has grown tremendously since the inaugural Assessment in 2009, as has our membership community, which now brings together the collective wisdom of the world’s leading investors, managers, consultants, industry associations and data providers.

Honoring our industry-driven legacy and the role our members play in defining ESG concepts for our sector, we are committed to providing greater opportunities for GRESB Members to contribute their leadership in shaping our Assessments and benchmarks. To facilitate this, we will be making clearer distinctions between participants and Members, laying the groundwork for a more intuitive organizational structure that provides greater long-term value to our stakeholders.

2. Technology: IT & Analytics Platform and Portal

The rapid advances of technology and big data taking place across the real asset industry are a rich source of opportunity for GRESB and benchmark participants. Together we’re creating a comprehensive industry-specific ESG performance data ecosystem, as well as the assurance structure and science to make it reliable and meaningful. This past year GRESB significantly invested in our data science and platform development capabilities. This coming year we will continue to further invest in the platform to improve usability, experience, data quality and analytics.

3. GRESB Assessments: Real Estate, Infrastructure and Debt

GRESB Real Estate participants should expect enhancements to asset-level reporting functionality and the integration of selected Health & Well-being Module elements. Developments to the GRESB Infrastructure Asset Assessment will include aligning sector classifications to industry standards, refinements to the materiality-based scoring process, and further standardization of Performance Indicators to ensure greater comparability of performance data within and across sectors. The Infrastructure Fund Assessment will benefit from a redesigned Fund-Asset linkage in the Portal. The Resilience Module will enter its second year with a strengthened scoring model and new indicators aligned with TCFD recommendations.

In late 2019, we plan to release the first version of the new GRESB ESG Data Quality Standard designed to provide industry guidance for high-quality data reporting. The goal of the Standard is to reduce reporting and validation efforts, while at the same time improving the reliability and quality of ESG data used and reported by the industry.

Over the last four years, the GRESB Debt Assessment has rated and ranked the quality of ESG integration among real estate lenders. While a motivated cohort of banks, real estate debt funds and mortgage REITs have found benefit from participating, the Debt Assessment in its current form does not enable investors or participants to evaluate the overall performance of portfolios where debt investments are held alongside real estate assets. Therefore, in place of a standalone Debt Assessment, we will work with lenders to monitor their real estate and infrastructure investments using the GRESB Real Estate and/or Infrastructure Assessments. In parallel, we are in discussions with several partners to evaluate whether they are interested in continuing the Debt Assessment.

Thank you for your support: past, present and future

None of the success and growth that we’ve experienced over the last nine years would have been possible without you: the institutional investors, fund managers, portfolio companies, property developers, asset operators and owners, industry partners, academic researchers, data partners and other leaders from around the globe who have supported GRESB by joining our shared vision.

We also owe a great debt to past and current members of the GRESB Board of Directors, along with our Advisory Boards, Regional Benchmark Committees and Industry Working Groups without whom the GRESB Assessments and benchmarks would not have achieved the industry standing they enjoy today.

Everyone at GRESB is thankful for your leadership, and with you, we look forward to a more sustainable future.

Here’s to a happy and impactful 2019 and beyond.

Sander Paul van Tongeren

Co-founder and Managing Director

GRESB

Download a PDF version: “GRESB: 2018 in Review and the Road Ahead“